Where you should invest now

A common question investors have, particularly during times of stock market volatility is where to invest your money. Should you invest in equities? How about bonds? Or perhaps you should keep your money in cash. And beyond that, are there certain countries or regions you should focus on. It can be pretty confusing, particularly with all the information and advice coming at you through the media, as well as your friends and family.

Some investors like to chase returns by focusing on sectors that have outperformed in the previous year, while others take a contrarian view – investing in sectors that have underperformed, expecting to get in low and ride the rising wave. But the issue with both of these strategies is that past performance is no indication of future returns.

To illustrate this point, let’s look at how various groups of investments have performed annually. Below you’ll see an asset allocation quilt chart produced by Morningstar Research. The chart shows performance boxes for equities based on geographic region -- Canada, US, International, European and Emerging Markets. There are also boxes for bonds and cash, as well as a hypothetical balanced portfolio. The boxes are arranged from highest return at the top to lowest return at the bottom.

Right away you’ll notice that there is very little consistency from year to year. If you just draw a line through all the purple boxes, for example, which represent Canadian equities, some years, it is right at the top and other years it’s at the bottom. The same thing goes for international equities (the orange box) -- lots of ups and downs over the past decade. Even Canadian bonds (the light green box), which you may think would remain steady, are inconsistent year-to-year. In 2013, for example, Canadian bonds lost 1.2% and the following year they made close to 9%. What does this tell us? That no region, sector or asset class is immune to ups and downs.

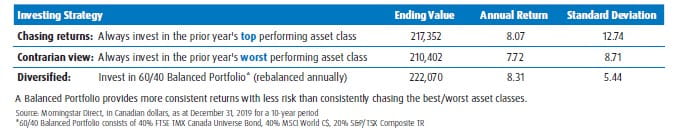

Now take a look at the grey boxes, which represent a hypothetical balanced portfolio. The interesting thing here is that, unlike individual asset classes, it stays pretty close to the middle. So while a well-balanced, well-diversified portfolio doesn’t necessarily give you any homeruns, you also aren’t going to strike out. It is how to take the guesswork out of picking the winners, avoiding the losers, and over time, see consistent results. In fact over a 10 year period, if you had always invested in the prior year’s top performing asset class you would have seen your annual returns at 8.07%; by investing in the prior year’s worst performing asset class, returns would come in at 7.72% and by simply holding a well-balanced and diversified portfolio containing 60% equities and 40% fixed-income, you would have seen annual returns of 8.31%.

Of course as we know, past performance is no guarantee of future returns and not everyone’s mix of investments will be the same. It’s very personalized. A lot of it will depend on things like your risk tolerance and your time horizon. You may want to generate income from your portfolio or have specific tax considerations. That’s why it’s so important to work with your advisor to build and manage a portfolio that’s right for you.